Founded in 2009, the International Integrated Reporting Council (IIRC) is a coalition of regulators, investors, companies, accounting professionals and non-government organisations (NGOs). The coalition works to communicate and promote corporate reporting that explains to investors how an organisation creates value over time through relationships with its key stakeholders, meaning employees, customers and products. The IIRC want corporate reports to include how the organisation understands and responds to stakeholder’s needs and interests,. IIRC believe that reporting only shareholder value is not a strategy, but a result, since it provides only limited information about a business.

The IIRC wants to move away from strategic decisions focused on the short-term goal of rewarding shareholders by increasing profits and dividends every quarter. They argue that this is a short-term outlook that neglects investment projects and future output.

Richard Howitt and the IIRC

Richard Howitt has been involved in the evolution of Integrated Reporting from the start. He was a member of HRH The Prince of Wales Annual Forum on Accounting for Sustainability which led to the foundation of the IIRC. From the start, Howitt represented the IIRC as a voluntary Ambassador at international meetings, promoting integrated reporting within the policy and business communities, helping the IIRC achieve success in driving change in corporate reporting in more than 25 countries.

Howitt started as Chief Executive Officer of IIRC in November 2016, succeeding Paul Druckman. Stepping down as an MEP of 22 years to take up his appointment, Howitt has been rapporteur on corporate reporting-related issues at the European Parliament. As lead-MEP on corporate responsibility, he represented the EU internationally and was pivotal in drawing up the EU’s non-financial information directive, one of the world’s biggest transformations in corporate disclosure.

IIRC Strategy

The IIRC Board’s strategy is to embed integrated reporting principles into global corporate governance practices.

Integrated Reporting

Integrated Reporting (IR)is a direct response to the spread of short-term risks in capital markets that cause uncertainty and volatility not just in business, but in economies, society and the environment. IR connects the financial details of an organisation with the relationships the organisation has with its key stakeholders and how it makes use of resources.

When looking at short-terms aims, an organisation rarely reports how they will develop the organisation in terms of intellectual capital, or relationship building with stakeholders and customers. Minimising environmental risks are rarely considered either, yet all are critical to long-term success. IR keeps the focus on long term strategy, with forward-looking documents that cover strategy, the context in which it will delivered and how the company plans to create value for providers of goods and capital over the short, medium and long term.

Why Integrated Reporting?

IR focus on all stakeholders including the business owners, investors and employees as well as customers, suppliers and creditors. Employees value a good working environment and pay. Customers appreciate quality, price and innovation in the products they purchase. Suppliers want a stable relationships and a fair contract. Creditors want a legitimate return on their loan. IR measures the return to each stakeholder.

In IR long-term production and profitability is the primary focus, leading to decisions that have been shown to increase the organisation’s competitiveness over time and builds social capital. Businesses with high social capital were shown to have higher stock returns, higher profitability, growth, and sales per employee when compared to low social capital businesses.

The International Integrated Reporting Framework

Traditional company reports contain gaps since they usually focus on the short-term financials. However, if company executives can work together to think about inputs and outcomes in broader terms, the organisation can create a broader picture of what adds value to the business and what needs to be managed.

The IIRC has developed the International IR Framework which recognises that long term success requires sound management, good relationships, a satisfied work force and the availability of natural resources as a foundation. To date, around 1,5000 global organisations have adopted the International Integrated Reporting Framework for their business.

The IIRC supports companies to take the first step towards integrated reporting so there is a shared understanding amongst employees about the social and environmental risks and their impact on reputation and the bottom line.

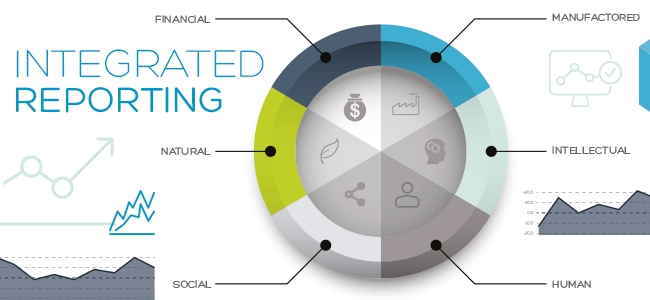

Consideration of inputs, outputs and outcomes help an organisation to take a broader view of the concept of value creation. These clarify their negative as well as positive impacts on financial, manufactured, intellectual, human, relationship, social and natural capital.

For clarification, outputs are different from outcomes. Outputs are the key products or services (together with all by-products and waste that these products or services) that create or reduce the value produced by an organisation. Outcomes are the internal and external financial consequences as a result of an organisation’s business activities and outputs.